Any degree that you choose to take at higher education institution can open up a range of different doors and opportunities for you.

Finance, in particular, can open a surprisingly large number of paths. With a degree in this subject, you’re not limited to just being an accountant or finance manager: there are plenty of other careers open to you. In addition, finance is widely recognized as one of the most lucrative sectors, and specialists can expect to earn high salaries.

In this article, we’ll outline what a master’s degree in finance can do for you, including what you will study, average salaries, and potential careers that will open up for you on graduation.

What will you learn during a master in finance program?

A master’s degree in finance will set you up for a successful career in a range of finance-related roles. Most degree courses will cover topics such as asset pricing, credit markets, portfolio management and financial risk management.

As the field changes, so will the curricula that you study. For example, topics such as cryptocurrencies and blockchain would not have been taught a decade ago but now form part of any syllabus.

If you choose to study the master in finance program at EU Business School, for example, some of the specific topics you will learn include:

- Financial reporting and statement analysis

- Quantitative methods for finance

- Microeconomic theory

- Fixed income securities and credit markets

- Financial markets and institutions

- Risk management in financial markets

- Mergers, buyouts and corporate restructuring

- Fundamentals of blockchain technologies

By the end of this master’s program, you’ll be able to:

- Apply financial theories and techniques to real-world situations

- Use sophisticated modelling techniques to manage corporate risk

- Evaluate emerging technologies, stocks, bonds and derivatives using industry-leading methods

- Understand and be able to find solutions to specific financial issues that multinational companies across the globe face on a daily basis

What careers are open to graduates with a master in finance?

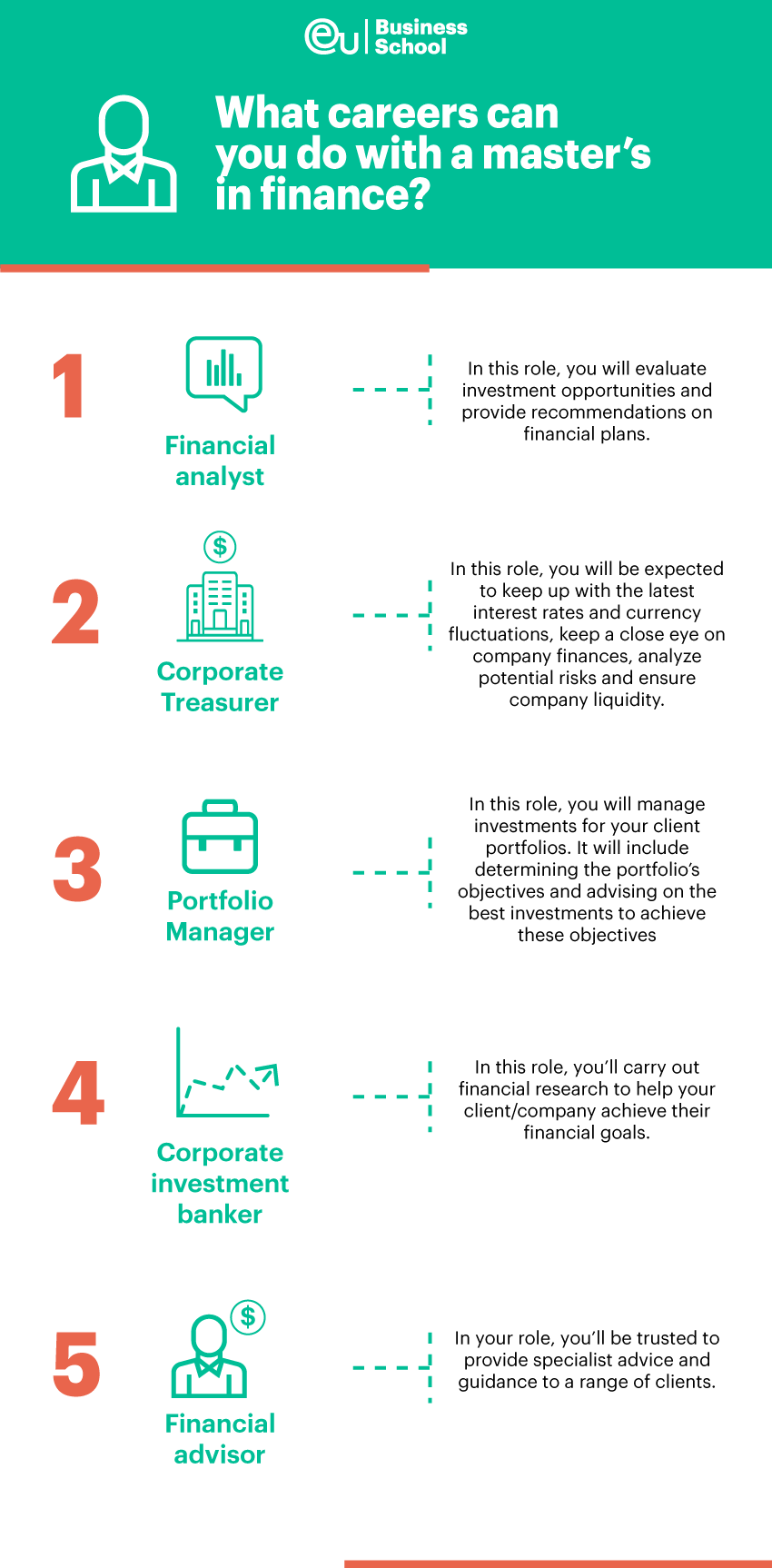

Here are just some of the potential careers that you could start upon graduating from your master’s program in finance.

Financial analyst

One of the most common jobs that finance graduates will find after university is a financial analyst. In this role, you will evaluate investment opportunities and provide recommendations on financial plans.

As a financial analyst, you may be employed in a wide range of businesses, including small and medium-sized companies, multinationals, non-profit organizations or government bodies. As a result, there are numerous opportunities to try new things and get involved with a variety of industries.

The average salary for a financial analyst is $59,026, with the potential to earn as much as $100,414 depending on the company and your seniority.

Corporate Treasurer

Corporate treasurers are methodical and detail-oriented people whose responsibility is to safeguard the financial health of the person/business for which they work.

This means protecting the person/business from any potential risks and ensuring that they’re meeting all of their financial obligations.

In this role, you will be expected to keep up with the latest interest rates and currency fluctuations, keep a close eye on company finances, analyze potential risks and ensure company liquidity.

This is an important job, and is not something you’ll be able to achieve as soon as you graduate – it will come after many years of experience. However, it may be a role that you aspire to have at some point in your career as the average earnings of a corporate treasurer is around $155,000 a year.

Portfolio Manager

If you have an interest in stocks, bonds and investing, becoming a portfolio manager could be a good career step for you.

In this role, you will manage investments for your client portfolios. Your role will include determining the portfolio’s objectives and advising on the best investments to achieve these objectives.

You will know how to balance profit and risk, but be an expert at research and data analysis.

If you want to pursue a career as a portfolio manager, you can expect to earn an average salary of around $81,590.

Corporate investment banker

If you love making money and have a keen interest in financial markets, you may be interested in being a corporate investment banker. In this role, you’ll carry out financial research to help your client/company achieve their financial goals.

You will define the best investment opportunities and provide strategic advice for the short and long term on how to make more profitable investments.

This role requires strong numerical skills and the ability to explain complex financial information in a simple way. Average salaries are around $96,476 a year.

Financial advisor

Not everyone has a good understanding of financial markets, and many may not have any interest in understanding how these markets work, but this doesn’t mean that they want to get the most out of their money – this is where financial advisors come in.

As a financial advisor, you’ll normally specialize in one discipline, such as savings, mortgages or taxes. In your role, you’ll be trusted to provide specialist advice and guidance to a range of clients.

You can either work as an independent advisor, or you can work in-house providing guidance to a particular company or individual. Depending on the nature of your work, you can expect to earn around $58,590 a year.

Study a master’s in finance at EU Business School

The master in finance program at EU Business School will prepare you for the workplace of the future. From its foundations to the future of finance, you will gain a balanced understanding of one of the most crucial aspects of business as well as gaining the entrepreneurial mindset essential for business excess.

Find out more about a master’s in finance with EU Business School.